Evan Palvan/iStock via Getty Images

While a lot of SPACs fail to achieve financial targets, the market continues to ignore businesses with strong growth potential such as WM . technology (Nasdaq: Charts). Cannabis technology provider and market do not Always hit financial goals, but Weedmaps owner is still growing at 30%. for me investment thesis Stocks are still trading bullish near the lows under $6.

strong work

WM Tech. It went through a few tough periods as unauthorized customers were cut off from the platform in both the US and Canada. The end result was a view that the business was struggling, but the fact is that the company has a solid business and the first-quarter results of ’22 highlight that situation.

The company reported revenue of $57.5 million, beating consensus estimates of $2.3 million. WM Tech. It returns to achieve sales growth of approximately 40% with a forecast of approximately 30% growth in the future. These growth rates are not of the kind typically associated with a 52-week decline for the stock.

WM Tech. It still shows the kind of growth opportunity that originally drove the stock above $20. The company has the largest cannabis market with technical drivers producing gross profit margins of 93%.

The user base jumped 52% to 16.4 million MAU. The commerce platform continues to grow at levels that make adding new payment customers almost automatic.

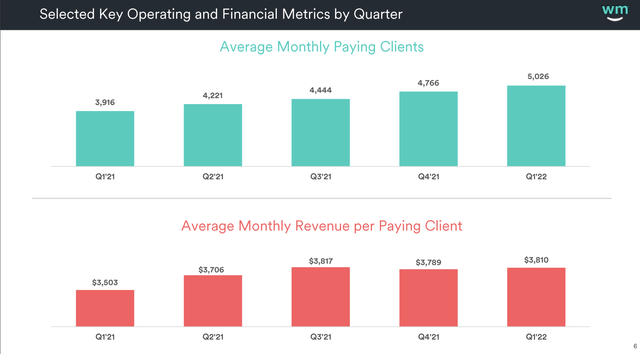

The company is driving the growth of paying customers along with average revenue per paying customer. In the first quarter of 2012, monthly revenue per customer increased 9% to $3,810 while number of customers grew 28% to $5,026.

Source: WM Tech. Q1’22 عرض Show

WM Tech. The quarter actually ended with 5,141 pay customers and monthly revenue for pay customers was $4,052. Monthly revenue for the quarter ended 6.4% above average for the first quarter of 2012, with numbers easily hitting a guidance high of $63.0 million. Business commenced in the second quarter of 2222 with a monthly run rate of $62.5 million.

The US cannabis market is not yet fully open with most states still operating under limited licenses led by multi-state operators (MSOs) and not the primary target of Weedmaps’ suite of solutions. As new states approve recreational cannabis sales and existing states open up retail licenses, WM Tech. Prepare to grow. For this reason, the company still gets the majority of revenue from the California market.

The market opportunities are enormous given that the alcohol market has 10 times that of retail stores. WM Tech. It produces 30% growth here with a lot of headwinds for the cannabis market. Ultimately, the market has a 1,000% upside potential to match the retail licensing density of a similar product in alcohol.

Not profitable yet

The market does not like WM Tech. He returned to report EBITDA losses. Despite having gross margins of 93% in the quarter, the stock market appears to be more concerned about short-term earnings versus the long-term growth opportunity of leading the cannabis field in technology and commerce.

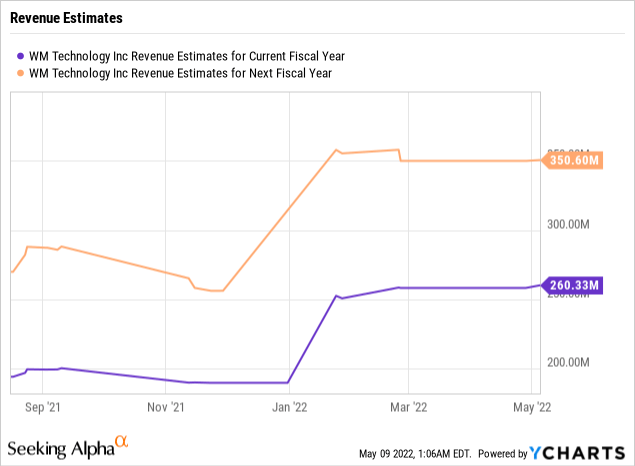

Revenue guidance for Q2 22 of $61.5 million is in line with analyst targets. The key here is WM Tech. Maintaining 30%+ growth rates push 2022 sales to $260 million and 2023 above $350 million.

To achieve 2022 goals, WM Tech. Sales of Q4’22 should reach $75 million. The stock contains 144 million outstanding shares for a market capitalization of $750 million. The stock is trading at only 2x 2023 sales targets with a net cash balance of $56 million.

These “non-profitable” stocks are out of favor in the market, but investors should snap up WM Tech. at these valuations and very close to break-even earnings. The only real stocks to avoid are those that have a huge cash burn that requires large increases in diluted shares.

WM Tech. Only $7 million of cash burned from operations in the quarter, primarily due to a similar jump in accounts receivable balances. Some clients in the California market are struggling to pay the bills and investors will want to monitor any impact on revenue in the future, although any client cutting off the market will naturally cause orders to flow to another client.

away

A key takeaway for an investor is that a tech-based market leader in a growth segment like cannabis often doesn’t trade at a 2x EV/S multiplier. WM Tech. He struggled out of the gate after the SPAC deal closed, but the company is firing on all cylinders again.

Investors should use the current weakness in the stock to load up the market leader.

Comments

Post a Comment