Every investor in LK Technology Holdings Limited HKG:558 should be familiar with the most powerful shareholder groups. And the group that owns the bulk of the pie are individual insiders with a 62% ownership interest. In other words, the group faces the maximum possible risk (or downside risk).

Looking at our data, we can see that insiders have recently bought shares. However, with the stock price down 8.9% last week, they must be disappointed.

Let’s take a closer look to see what different types of shareholders can tell us about LK Technology Holdings.

Check out our latest analysis for LK Technology Holdings

What does corporate ownership tell us about LK Technology Holdings?

Institutions typically measure themselves against a benchmark when reporting to their investors, so they often get more excited about a stock once it’s included in a major index. We expect most companies to have some foundation on record, especially if they are growing.

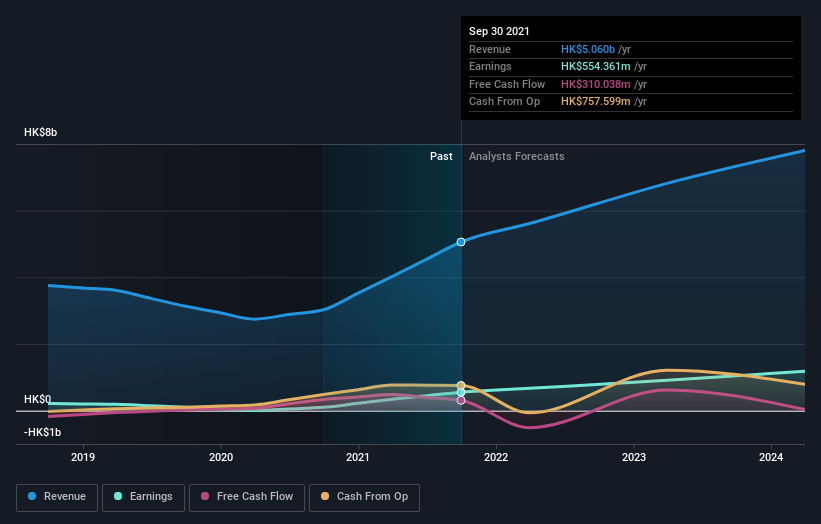

Since organizations only own a small portion of LK Technology Holdings, they may not have spent much time thinking about inventory. But some clearly have; And they liked it enough to buy. If business gets stronger from here, we could see a situation where more organizations are keen to buy. It is not uncommon to see a significant rise in stock prices if several institutional investors try to buy shares at the same time. So check out the historical earnings path below, but keep in mind that the future is what matters most.

Hedge funds seem to own 9.6% of the shares of LK Technology Holdings. This is interesting, because hedge funds can be very active and energetic. Many are looking for catalysts in the medium term that will push the stock price higher. Since actions speak louder than words, we consider it a good sign when insiders own a large stake in the company. In the case of LK Technology Holdings, the CEO, Siw Yin Chong, is the largest shareholder, owning 62% of the shares outstanding. The Vanguard Group, Inc. The second largest shareholder owns 0.9% of the common stock, and Norges Bank Investment Management owns approximately 0.3% of the company’s shares.

While studying the institutional ownership of a company can add value to your research, it is also a good practice to research analyst recommendations to gain a deeper understanding of the stock’s expected performance. There are a fair number of analysts covering stocks, so it can be helpful to know their overall view of the future.

Internal ownership of LK Technology Holdings

While the exact definition of an insider can be subjective, almost everyone considers board members to be an insider. The company’s management runs the business, but the CEO will be accountable to the board of directors, even if he is a member of it.

Ownership from the inside is positive when it indicates that the leadership thinks like the true owners of the company. However, high internal ownership can give tremendous power to a small group within a company. This can be a negative in some circumstances.

Insiders seem to own more than half of the shares of LK Technology Holdings Limited. This gives them a lot of power. This means that insiders have a very meaningful stake of HK$7.8 billion in this HK$13 billion business. Most would argue that this is a positive, and it shows a strong alignment with the shareholders. You can click here to see if they are selling their stakes.

public domain

The general public, usually individual investors, owns a 25% stake in LK Technology Holdings. This size of ownership may not be sufficient to change the company’s policy if the decision is not synchronized with other major shareholders.

Next steps:

I find it interesting to know exactly who owns a company. But to really gain insight, we need to consider other information as well. Case in point: We spotted One Warning Sign for LK Technology Holdings You should be aware.

If you’re like me, you might want to consider whether this company will grow or shrink. Fortunately, you can check out this free report showing analysts’ forecasts for its future.

Note: The numbers in this article are calculated using data from the last twelve months, which refers to the 12-month period ending on the last date of the month in which the financial statement was dated. This may not be consistent with the annual report numbers for the full year.

Do you have feedback on this article? Worried about the content? keep in touch with us directly. Alternatively, email the editorial team (at) simplewallst.com.

This article by Simply Wall St is general in nature. We provide comments based only on historical data and analyst expectations using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, nor does it take into account your objectives or financial situation. We aim to provide you with focused, long-term analysis driven by essential data. Note that our analysis may not include the company’s most recent price-sensitive ads or quality materials. Wall Street simply has no position in any of the stocks mentioned.

Comments

Post a Comment