Apple continues to diversify its supply chain away from China. At least that's what Reuters recently suggested in its report that the iPhone 13 will now be produced in India. This will be the fourth smartphone model from Apple to be manufactured in this country.

Cupertino's supply chain moves are significant. Here is what is Apple stock (AAPL) - Get the Apple Inc. report. Investors should know about it.

(Read more from Apple Maven: 3 interesting facts about Apple stock in the first quarter of 2022)

Apple leans less on China

Nearly two years ago, Apple Maven explained that Apple's supply chain was too dependent on China. At the time, it was estimated that nearly half of Apple's top suppliers are located in that Asian country.

To be clear, mainland China is still an important supply center for Cupertino. But make no mistake: Tim Cook and his crew have recently taken steps to diversify the company's procurement channels away from China.

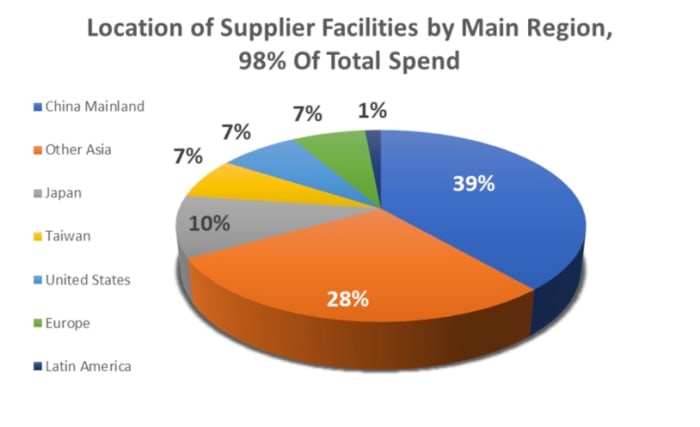

The chart below, from Apple's most recently published list of suppliers, shows the distribution of supplier factories by country. It's worth noting that the graph does not quantify how much each region contributes to Apple's supply chain, either in terms of volume shipped or value added.

Figure 2: Location of Apple supplier facilities by major region, 98% of total spending.

DM Martins Research

Compared to the data I published in June 2020, some key changes stand out:

- Apple is becoming less dependent on China. Only about 39% of suppliers were in the country last year, compared to 48% in the previous 12-month period.

- Asian countries other than China, Taiwan and Japan have gained prominence: 28% of the total number of suppliers are in places like South Korea, Vietnam and the Philippines versus just 17% in 2020.

- Suppliers located in Europe rose to 7% of the total, the same as in the US or Taiwan, up from just 4% two years ago.

- India is becoming a more important supplier to Apple, but modestly so far. As of mid-2021, there were 10 of them in the country, including the iPhone Foxconn complex in the southern state of Tamil Nadu, versus 9 in 2020.

But what does that mean?

Perhaps it was no accident that Apple's supply chain diversified away from China. Trade relations between the United States and the United States deteriorated in 2018, when both became embroiled in a trade war that resulted in nothing more than rising import costs and stock market uncertainty.

By relying less on China, I think Apple is strengthening its supply chain - something that has become even more important during the period of turmoil that followed the pandemic. Positive impact could include more product availability, and possibly cost stability.

I think that strong supply chain management is one reason to be optimistic about Apple stock. For now, the data still suggests that the Cupertino company is doing well on this front.

(Read more from Apple Maven: How Apple Stock Benefited From Margin Expansion)

(Disclaimer: This is not investment advice. The author may be one or more of the stocks mentioned in this report. Also, the article may contain affiliate links. These partnerships do not affect editorial content. Thank you for supporting The Apple Maven)

Comments

Post a Comment